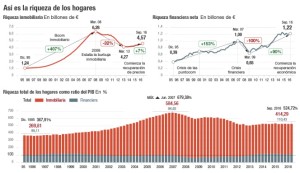

In full boom the value of the homes in hands of the families came to overcome in 9,2 times the financial wealth.

El fuerte ajuste que sufrieron los precios de los inmuebles tras el estallido de la burbuja ha mermado el valor del heritage of Spanish households, Although the latest figures attest to how families still treasure much more wealth in homes than in financial products. The Bank of Spain constata que la riqueza inmobiliaria de los hogares es hoy 3,7 exceeding the financial times.

Cultural and sociological factors on one side and public policies, on the other hand, did that in Spain began already during the dictatorship to spread the taste by the property of housing. La revolución del mortgage market and the entry into the euro después culminaron el caldo de cultivo para que a partir de finales de los años noventa comenzara a gestarse el boom inmobiliario más duradero de la historia reciente. In addition, este fenómeno coincidió con la llegada al mercado de la vivienda de la cohort of people more numerous of the century, los nacidos en el baby boom, age of emancipation and, for this reason, need to buy flats.

Read more: http://cincodias.com/cincodias/2017/01/20/economia/1484940870_885204.html

All this gave rise to a market which had to respond very quickly to a unbridled demand for houses; what caused the escalation of prices high and most prolonged in recent years time. Fueron los tiempos de "housing is the most profitable investment, or brick never loses value". However, starting from 2008 and with the outbreak of the global financial and economic crisis all these premises jumped through the air. Pero mucho antes de que eso ocurriera España ya lideraba los ranking de países donde más families were owners of the House where they lived, with more than the 80%; or it is crowned as the nation with the highest proportion of homes by home (became of 1,5 While today has moderated to 1,3).

Like this, the historical series that makes the Bank of Spain on the real estate and financial wealth of households perfectly reflect this situation. The first data that allow to compare two variables go back to 1995, just before the start the boom.

On that date, los hogares españoles contaban con una real estate wealth of 1,1 billion euros and a net financial wealth of 396.396 million. The proportion was three times. Today, more than 20 years later the family treasure 4,57 billion in housing, figure that is 3,7 times superior to them 1,21 billions that adds your net financial wealth. But, How to measure a and another variable?

Methods of calculation

Real estate wealth, According to sources from the Bank of Spain is explained, se calcula teniendo en cuenta el total home park, its surface media and is updated every year with the price per square metre which published official statistics. The resulting figures, However, are they purged taking into account houses that are incorporated each year into the Park, Since census is carried out every 10 years old, and coming out of it because they are ruined. The same sources admit, that Yes, that the overall figure of real estate wealth does not discriminate to that part of these houses are owned by non-residents.

In any case, tal y como reconoce el Professor of Economics applied of the University autonomous of Barcelona Josep Oliver, There is almost another way of measuring this variable. In terms of financial wealth, This is much easier to quantify. It consists of adding the value of the financial assets of households such as cash in bank accounts, those deposits, shares and participations in companies, insurance and plans or pension funds, among others.

Para que la wealth financial is net, a ese valor se le restan los liabilities que son el endeudamiento o préstamos contraidos por los mismos hogares, both the short and long term; de los cuales el grueso está precisely to finance the purchase of houses. The sum of real estate wealth and the financial net of families is the total household wealth, que a septiembre pasado equivalía al 524,7% of the GDP.

Tanto Josep Oliver como el Director of conjuncture and Funcas statistics, Raymond Torres, coincide in pointing that this greater weight of the wealth real estate is characteristic of Spain facing what happens in the rest of Europe, donde los hogares se decantan mayoritariamente por otra clase de activos como son los pension and investment funds o la compra de acciones en Bolsa.

Whether or not it is healthy that the promotion between the inverted in brick is so high against financial assets, explain that it ideal would diversify more to reduce the risks in case of crisis. In fact, the historical series shows how at the beginning of 2009, When even the houses not had corrected their prices and bags around the world already had been depreciated as a result of the global recession, real estate wealth came to be 9,2 veces el patrimonio financiero neto. Luis Corral, Chief Executive of Forum consultants, ensures that the ideal would be to real estate wealth to require the 50%-60% of the total wealth, "since that would be not be subject to the ups and downs of the market and have liquidity immediately in case of need".

A comparative European with surprises and special features

The wealth of families in Spain is a paradigmatic case within Europe, Although it is not the only. Tomorrow the Bank of Spain will update the financial survey of households with data up to 2014, one of the first studies statistical that was capable of measuring the behavior of the families, what they spent their disposable income and how varied that pattern depending on your level of income.

A report that was later emulated by many European countries. Even the ECB compiled figures to elaborate a European comparison that showed surprising results. The latest data from your report, relating to 2013, caused a great stir to the reveal that in terms global them homes Spanish or Cypriot were quite more rich that the German by the greater weight of the housing in these countries. The difference between the median wealth and media in Germany was considerable (51.000 and 195.000 euros, respectively). This is due to that, Unlike other countries in the euro area, in Germany the home medium not is owner of your first House (just a 40% families are owners of the House where they reside, half that of Spain). In addition, the data relating to the home German medium revealed rates of saving considerably greater in those homes with mortgage, that in the rest of families.

All the experts consulted are confident that now that the car is gaining followers in Spain (in 2015 was the 15,6% household when in 2001 hardly represented the 9,6%), has opened up the debate on the future sustainability of pensions, and the experience of this crisis is recent; households begin to diversify their investments and learn the lesson that housing can do lose value. "We need more financial culture, as well as public policies that encourage long-term savings", says Raymond Torres, funcas. Experts expect that the teaching of this crisis translates into more prudently and that the household indebtedness does not exceed the 120% of their disposable income.