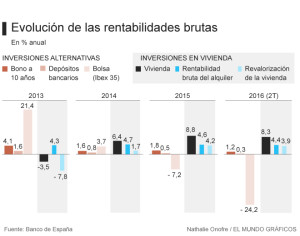

According to the Bank of Spain, the residential sector reaches half this performance in two ways: rent (4,4%) and its appreciation (3,9%)

Profitability in Madrid reaches the 8,08% annual, the floors of less of 70 square meters and the District of Villaverde as spearheads

Neither bank deposits, the bag, the bonds. Currently, the best investment is housing. This asset offers next to the double-digit annual average gross profitability. There is no financial product of low risk that comes close to this performance and seems very difficult to have it as to interest rates, the price of money, continue stuck in the 0%.

Exactly, According to the Bank of Spain (BE), la rentabilidad en el sector inmobiliario residencial asciende hasta el 8,3%. Este porcentaje resulta de la suma de la explotación de la vivienda a través del for rent (4,4%) and its value (3,9%). Other alternative investments as the bonus to 10 years or bank deposits just give a 1,2% and a 0,3%, respectively. Worst still describes the bag (Ibex 35): -24,2%.

Esta location of the dwelling as a great asset investment se da por los precios de venta al alza y un mercado del alquiler en crecimiento. According to real estate experts and economists, These two parameters give faith in addition to aresidential market standard and balanced con un doble reflejo. First: the investor in housing already does not buy an apartment for profitability in the short term with sale (in thick words, already doesn't speculate), but its objective through leasing and receive a regular income. And second: the car has stripped of their historical prejudices, What has led to more than one 20% Park residential Spanish is already subject to this regime.

As it could not be otherwise, before this buoyant picture of the housing, tanto los professional investors como los particulares han visto en el patrimonio inmobiliario residencial the best basket to put their funds and savings. Even mortgaging is, every time you access low cost loans, by a fixed interest rate, of the 2% or less - well below the profitability level of the 8,3%-. “The banks return to grant mortgages, so the investment in housing has not been limited to national or international funds, but that small and medium inverter can also make it”, comments Elisenda Picart, experta del comparador de productos financieros HelpMycash.com.

“Without a doubt, housing is one of the best investments of the moment. It has less risk than the stock markets and yields higher than traditional savings products”, supports Picart, who remembers that la crisis ha dejado el precio de los inmuebles a un nivel muy bajo y un coste de financiación mucho más asequible. Grupo Tecnocasa pone números a esta tendencia: a 26,5% purchases that brokered in the first half of the year were made as investment and most (78,5%) paid in cash.

Alternative investments

In addition to the traditional purchase of an apartment for your subsequent rental, There are other alternative investment routes for the particular. Picart cita el crowdfunding para sacar aún mayor jugo a una vivienda y pone de ejemplo la plataforma Housers, with returns of up to the 15%. “This form of investment has been years succeeding in countries such as the US and has come to Spain. This is where investors acquire shares of real estate and projects receive a proportional return for future sale and rental. One of the great advantages of this formula is the minimum amount to invest, from 50 euros, so it's more accessible than traditional”, says.

Otro método alternativo de inversión es el que abandera Inveriplus, company that transforms toxic assets into liquid and with some 5.500 houses in management. This signature, como explica its executive director, Oscar Bellette, sanea carteras de pisos de promotoras que no han podido venderse. “Inveriplus acquires these floors, promotions full or the product remaining, After reaching an agreement, a remover, with creditor banks and are exploited in lease”, comments.

[The new life of the amber Tower]

“Profitability for rent which give these properties depends on the area, but on average exceeds the 4,8% NET”, Specifies Bellette, at the time, indicating that the average rent is in turning a 520 euros per month and the period of stay is close to three years. “In addition”, remarks, “se trata de un benefit secured contracts have an insurance of non-payment”. Esta empresa también obtiene un beneficio por la venta de paquetes de viviendas, mainly, to your investment or external funds, While still maintaining these asset management.

On the other hand, an investor of a foot can also enter into the business of Inveriplus in two ways. On the one hand, esta empresa tiene un proyecto piloto with a divestment approach to five years through which sells apartments (It has sold 18 housing to 18 individuals so far) with a discount of the appraised value and giving a three-way interest: the rebate on the appraised value, the rental yield and the potential sale surplus. “We estimate the total profitability by 7.5%”, Figure Bellette.

La segunda forma de invertir para un particular en Inveriplus es a través de la transfer of rights of rental. Inveriplus, to make the banks with mortgage titling, It is sold to a third party the rights of a flat leased with their insurance of non-payment for a period and over the management continue to be. “Investor acquires these rights for an amount less than monthly incomes that will end up charging. We are talking about a fixed interest rate of the 5%. For example, If the rights are purchased for one year of a House with a monthly income of 500 euros can be paid as a 5.700 and finally charged 6.000 (500 euros by 12 months”, detailed Bellette, that you know no other company that offers this type of investment.

At this point in alternative investments, hay que hacer referencia a las Socimis, an attractive investment vehicle focused on the rental of all types of real estate. Through these societies., with a very favorable tax treatment, qualified investors have begun to bet firmly on the leasing of houses after a few first years that these listed companies focused on hotels and offices. that Yes, for the time being, they are not available to the individual investor.

Risks

Thinking about this profile, Picart warns of the risks of buying to rent: “First, It should be clear that it is investment in which large amounts of money are handled. In addition, If you ask a mortgage, one is attached to the Bank for many years. At last, se debe ser consciente de que It will be a long time before to recover the initial investment, so the benefits are not imminent”.

For all these reasons, la profesional de HelpMyCash.com aconseja a los inversores en vivienda que no se endeuden por encima de sus posibilidades aunque el banco lo permita con tipos de interés mínimos. For those who decide to take the step, Picart identifies the assets that secure success: ”Real estate in areas on the rise”. ”In those locations”, explains, “It is very likely that the square meter price increase, so if the property is sold in the future would be winning”. “In addition”, continues, “in these areas there will be facilities to find tenants and be able to take advantage quickly to investment”.

In this sense, the most interesting locations for investors are large provincial capitals, with Madrid and Barcelona a la cabeza. And within these cities, We must not forget the heterogeneity of the market, por lo que hay un producto y unos barrios mucho más rentables que otros. Urban Data Anlytics (uDA), firma especializada en el análisis de datos del mercado de la vivienda, He has dissected map of the capital, identifying the best investment areas.

Read more:

http://www.elmundo.es/economia/2016/10/28/581219d3ca47418f0b8b4582.html